Goodyear Reports Record Second Quarter Results

29 Jul 15

AKRON, Ohio, July 29, 2015 – The Goodyear Tire & Rubber Company today reported record results for the second quarter of 2015.

“We delivered outstanding segment operating income growth and achieved a segment operating margin of more than 13 percent, despite significant foreign currency and global economic headwinds,” said Richard J. Kramer, chairman and chief executive officer.

“North America continued to lead the way with a 54 percent increase in segment operating income and a 16 percent segment operating margin driven by strong demand for our products,” he said. “Additionally, three of our four businesses posted segment operating margins in excess of

10 percent.”

Kramer added, “Our strong second quarter results – even amid ongoing global challenges – reflect the strength of our strategy and of our value proposition.”

Goodyear’s second quarter 2015 sales were $4.2 billion, down from $4.7 billion a year ago, with the decrease largely attributable to unfavorable foreign currency translation of $401 million.

Tire unit volumes totaled 40.8 million for the second quarter of 2015, up 1 percent from last year. Original equipment unit volume was up 4 percent. Replacement tire shipments were down

1 percent.

The company reported second quarter segment operating income of $556 million in 2015,

up 21 percent from a year ago and a record for any quarter. The increase in segment operating income was driven by favorable price/mix net of raw materials and cost reduction actions. These were partially offset by inflation and unfavorable foreign currency translation.

Goodyear’s second quarter 2015 net income was $192 million (70 cents per share). Excluding certain significant items, adjusted net income was $229 million (84 cents per share). Per share amounts are diluted.

Second quarter 2015 adjusted net income was also impacted by $79 million (29 cents per share) of U.S. tax expense following the release of the company’s U.S. tax valuation allowance in the fourth quarter of 2014. Due to tax credits and prior tax-loss carryforwards, the company does not expect to pay significant cash income taxes in the United States for about five years.

Goodyear’s second quarter 2014 net income was $213 million (76 cents per share). Excluding certain significant items, adjusted net income was $225 million (80 cents per share). Per share amounts are diluted.

Year to Date

Goodyear’s sales for the first six months of 2015 were $8.2 billion, down 10 percent from the 2014 period, reflecting unfavorable foreign currency translation of $794 million. Tire unit volumes totaled 81.6 million for the first half of 2015, up 1 percent from 2014. Replacement tire shipments were up 1 percent. Original equipment unit volume was up 3 percent.

The company’s first half segment operating income of $947 million was up 14 percent from last year and a record. Compared to the prior year, year-to-date segment operating income reflects the benefits of favorable price/mix net of raw materials and cost reduction actions, which exceeded the impact of inflation and unfavorable foreign currency translation.

Goodyear’s year-to-date net income available to common shareholders of $416 million ($1.52 per share) is up from $155 million (58 cents per share) in 2014’s first half. All per share amounts are diluted.

See the note at the end of this release for further explanation and reconciliation tables for Segment Operating Income and Margin; Free Cash Flow from Operations; Adjusted Net Income; and Adjusted Diluted Earnings per Share, reflecting the impact of certain significant items on the 2015 and 2014 periods.

Business Segment Results

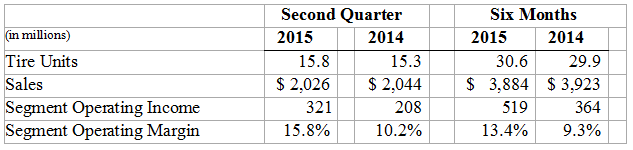

North America

North America’s second quarter 2015 sales decreased 1 percent from last year. A 3 percent increase in tire unit volume was more than offset by a decrease in third-party chemical sales. Replacement tire shipments were up 1 percent. Original equipment unit volume was up 9 percent.

Second quarter 2015 segment operating income of $321 million was a 54 percent improvement over the prior year and a record for any quarter. The improvement was driven by favorable price/mix net of raw materials and higher tire volume.

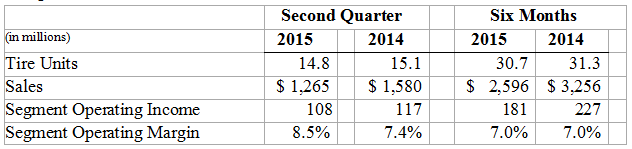

Europe, Middle East and Africa

Second quarter 2015 segment operating income of $108 million was 8 percent below the prior year due to unfavorable foreign currency translation, which more than offset favorable price/mix net of raw materials.Europe, Middle East and Africa’s second quarter sales decreased 20 percent from last year to

$1.3 billion, primarily due to unfavorable foreign currency translation. Sales also reflect a 2 percent decrease in tire unit volume, due to lower consumer tire sales and the company’s exit from the farm tire business. Replacement tire shipments were down 2 percent. Original equipment unit volume was down 2 percent.

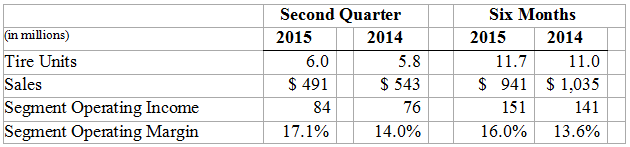

Asia Pacific

While Asia Pacific’s second quarter tire unit volumes increased 5 percent, sales decreased 10 percent as volume growth was more than offset by unfavorable foreign currency translation and lower price/mix resulting from the impact of lower raw material costs on pricing. Replacement tire shipments were up 1 percent. Original equipment unit volume was up 11 percent, primarily in China and India.

Second quarter 2015 segment operating income of $84 million was up 11 percent from last year, primarily driven by improved volume and favorable price/mix net of raw materials, partially offset by higher SAG expenses.

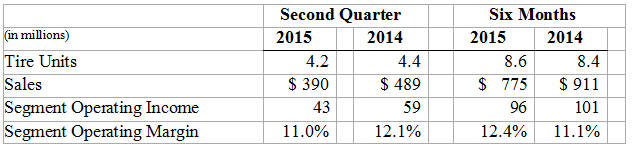

Latin America

Latin America’s second quarter sales decreased 20 percent from last year to $390 million, due primarily to unfavorable foreign currency translation. Sales also reflect a 4 percent decrease in tire unit volume, primarily driven by a weak economy in Brazil and Venezuela. Replacement tire shipments were down 2 percent. Original equipment unit volume was down 11 percent.

Second quarter segment operating income of $43 million was down 27 percent from a year ago primarily due to the impact of inflation on both raw material and conversion costs as well as lower volume, partially offset by favorable price/mix.

Operating income in Venezuela was $36 million, up $17 million from 2014’s second quarter. This operating income excludes foreign currency exchange losses related to the Venezuelan bolivar fuerte, which were $12 million in the quarter and represented a $19 million greater loss versus the second quarter of 2014. The company previously indicated that it expected no earnings contribution from its Venezuelan operations in the second quarter.

Outlook

The company reaffirmed its 2015-2016 financial targets, which include:

– Segment Operating Income growth of between 10 percent and 15 percent per year;

– Annual positive Free Cash Flow from Operations and,

– An Adjusted Debt to EBITDAP ratio of 2.0x to 2.1x.

Shareholder Return Program

The company paid a quarterly dividend of 6 cents per share of common stock on June 1, 2015. The Board of Directors has declared a quarterly dividend of 6 cents per share payable September 1, 2015, to shareholders of record on July 31, 2015.

As a part of its previously announced $450 million share repurchase program, the company repurchased 1.6 million shares of its common stock for $50 million during the second quarter.

About Goodyear

Goodyear is one of the world’s largest tire companies. It employs about 67,000 people and manufactures its products in 50 facilities in 22 countries around the world. Its two Innovation Centers in Akron, Ohio and Colmar-Berg, Luxembourg strive to develop state-of-the-art products and services that set the technology and performance standard for the industry. For more information about Goodyear and its products, go to www.goodyear.com/corporate.